At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

Fund Manager | CIC Asset Management Ltd |

Launch Date | May - 18 |

Risk Profile | Low - Moderate |

Trustee | Kenya Commercial Bank |

Custodian | Co-op Custodial Services |

Auditors | Kirenge & Associates |

Fund Objective

The fund provides a solution to organizations that find setting up a Retirement Fund and continuously comply-ing with the complex legal and statutory demands a challenge in both monetary and human resource cost.

SMEs and start-up organizations.

Fund Outlook

Global risks continue negatively affecting our stock market, and coupled with the interest rate hikes in de-veloped economies, foreign exits have sustained. The low prices in the market continue to provide attrac-tive price points into stocks with strong fundamentals and perpetual dividend payout thus locking in good yields.The government continues relying on the domestic debt market to meets is deficit owing to expensive external debt financing. Rates on government securities are hence expected to continue increasing in the near term.The fund will continue being affected by the downturn in the stock market but the bond performance will support stable performance.The fund will continue being affected by the downturn in the stock market but the bond performance will support stable performance.

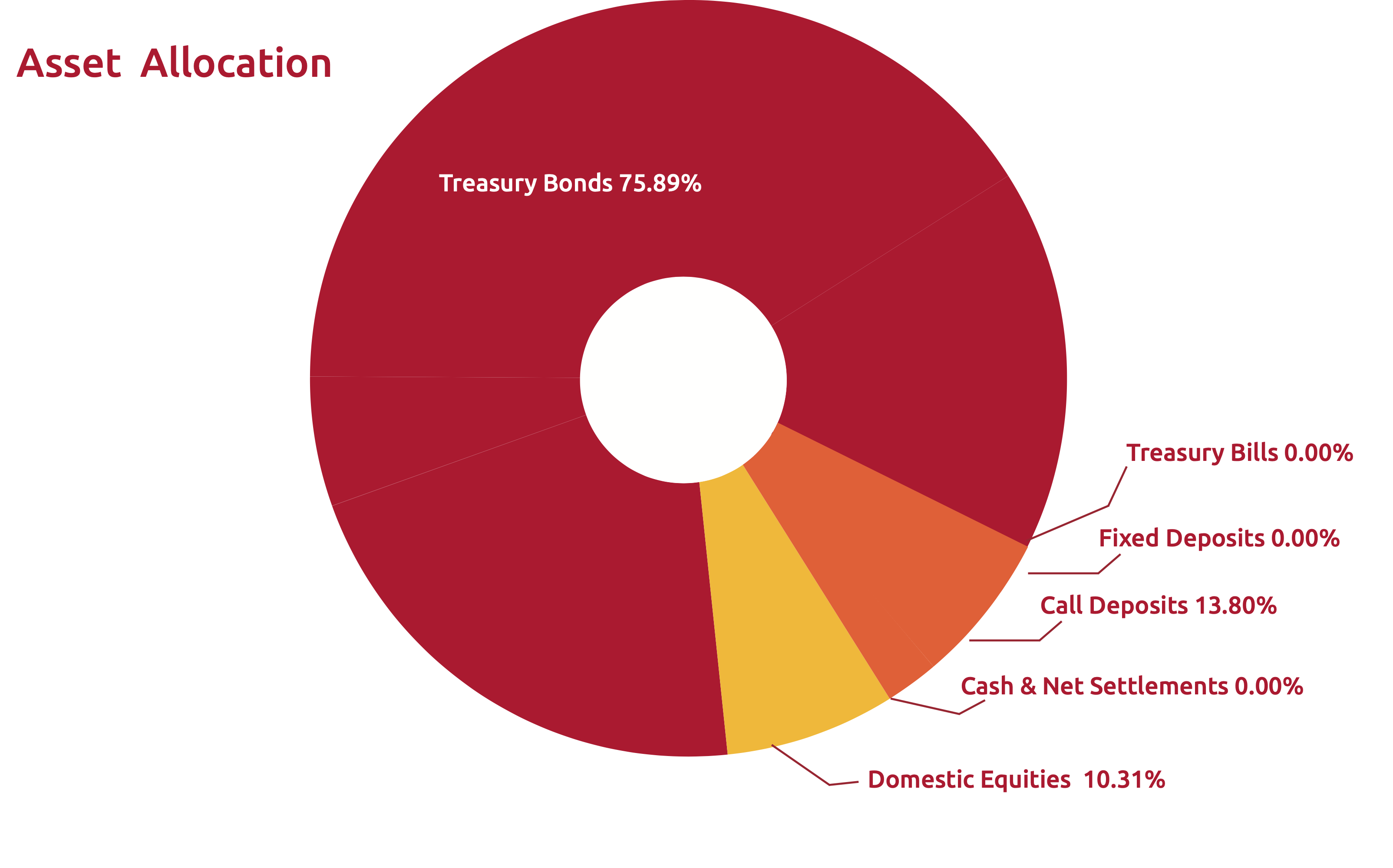

Asset Allocation

GDP

In Q3 2023, economic activity grew by 5.9% with positive effects from a recovery in the agricultural sector and tourism receipts. CBK projections show that Kenya’s annual real GDP growth is expected to come in at 5.5% in 2023.

Inflation

The inflation rate closed the year at 6.6% which was within the upper bound of CBK’s target 7.50%. The disinflation was largely due to a slower growth in the food & non-alcoholic beverages following improved supply from better weather conditions.

Equities

The NSE-20 and NASI declined by 4.2% and 11% respectively led by sell off in blue-chip counters such as KCB Bank, Equity Bank and Safaricom. Overall, investor risk appetite remains muted due to the tough macroeconomic environment and high interest rates in the money markets.

Exchange Rates

Interest Rates

In 4Q23, the short term tenors closed at 15.88%, 15.97% and 15.90% for the 91, 182 and 364-day papers. Investors remained biased towards short maturities.

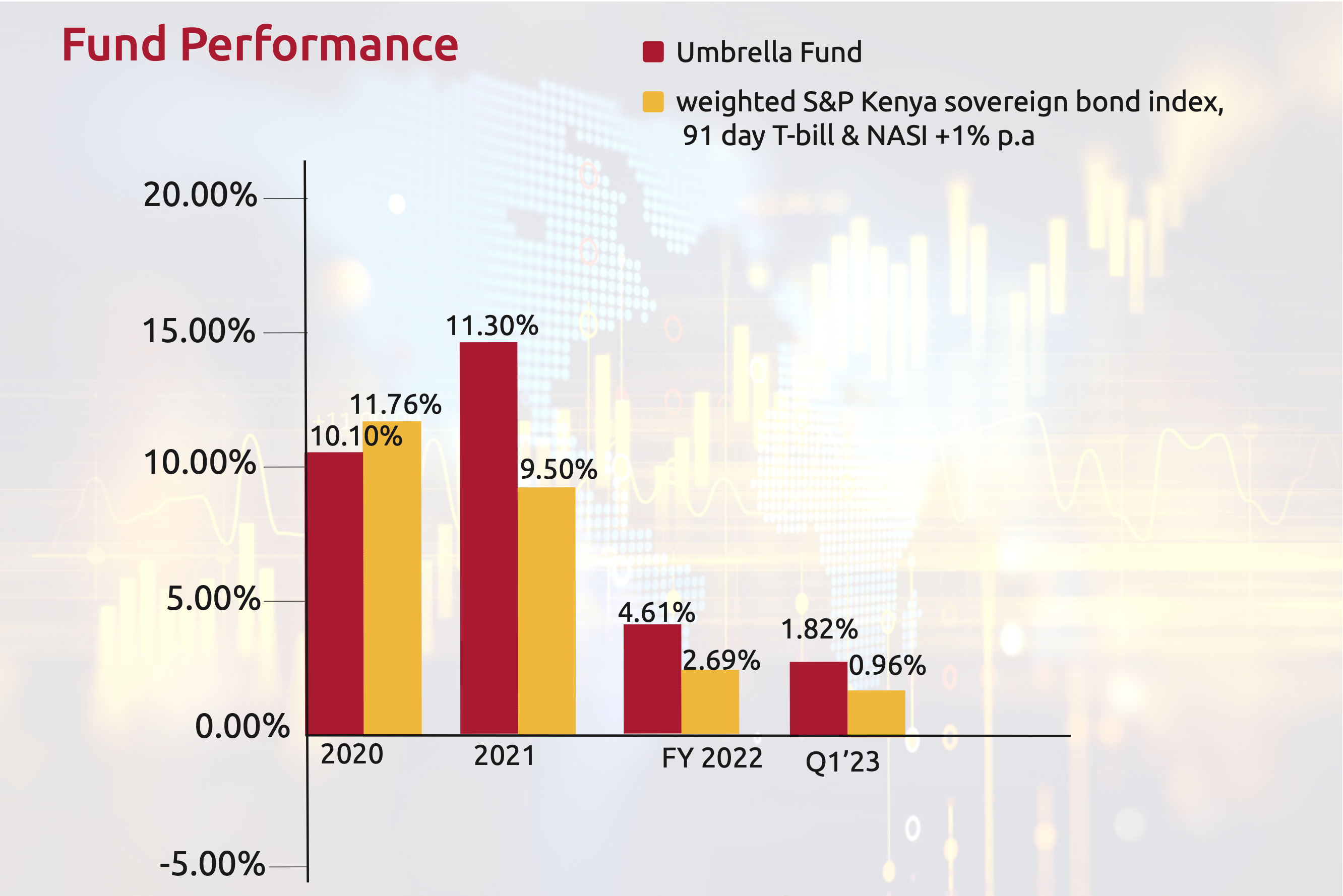

Fund Performance

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantee on the client’s capital as the performance of units in the fund is determined by change in the value of underlying investments hence value of your unit trust investment