At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

Fund Manager | CIC Asset Management Ltd |

Launch Date | Jun - 11 |

Risk Profile | Low - Medium |

Trustee | Kenya Commercial Bank |

Custodian | Co-op Custodial Services |

Auditors | PWC |

Minimum Investment | Ksh 5,000.00 |

Minimum Additional Investment | Ksh 1,000.00 |

Initial Fee | 0 |

Annual Management Fee | 2.00% |

Distribution | Monthly |

Fund Objective

Capital preservation whilst getting inflation protection.

High degree of capital stability with limited risk.

A short-term parking bay for surplus funds particularly in times of market volatility.

Key Benefits

- Liquidity: The client is able to withdraw their funds at short notice with no penalty fees.

- Flexibility: The client is able to switch or transfer funds to another fund that he/she may have with CICAM.

- Security: The fund invests in government paper and liquid instruments.

- Competitive Returns: Interest is calculated daily and credited at the end of each month. As an institutional client, the fund benefits from placing deposits in large sums and as such is able to negotiate for competitive rates.

- Professional fund management: prospective investors benefit from the expertise of our seasoned professionals.

GDP

In Q3 2023, economic activity grew by 5.9% with positive effects from a recovery in the agricultural sector and tourism receipts. CBK projections show that Kenya’s annual real GDP growth is expected to come in at 5.5% in 2023.

Inflation

The inflation rate closed the year at 6.6% which was within the upper bound of CBK’s target 7.50%. The disinflation was largely due to a slower growth in the food & non-alcoholic beverages following improved supply from better weather conditions.

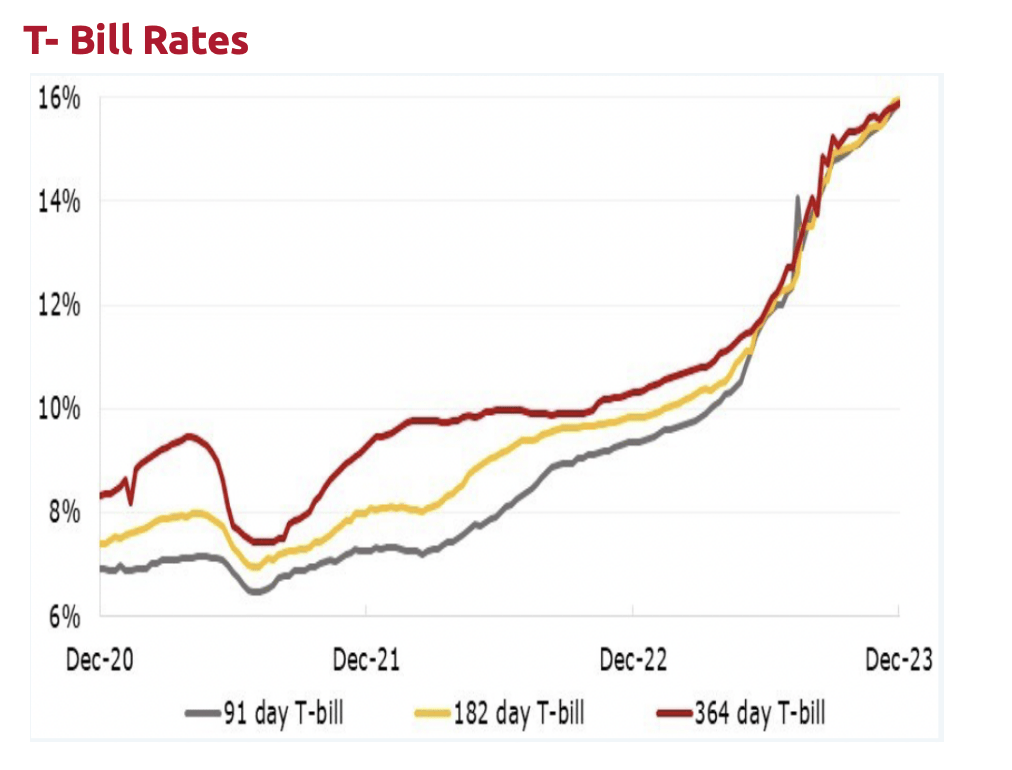

Interest Rates

In 4Q23, the short term tenors closed at 15.88%, 15.97% and 15.90% for the 91, 182 and 364-day papers. Investors remained biased towards short maturities.

Outlook

Rates on government securities have continued increasing in the quarter, and the same is expected to persist in the near term. The money market fund rate is therefore expected to gradually increase as maturities are repriced to reflect the increased rates.

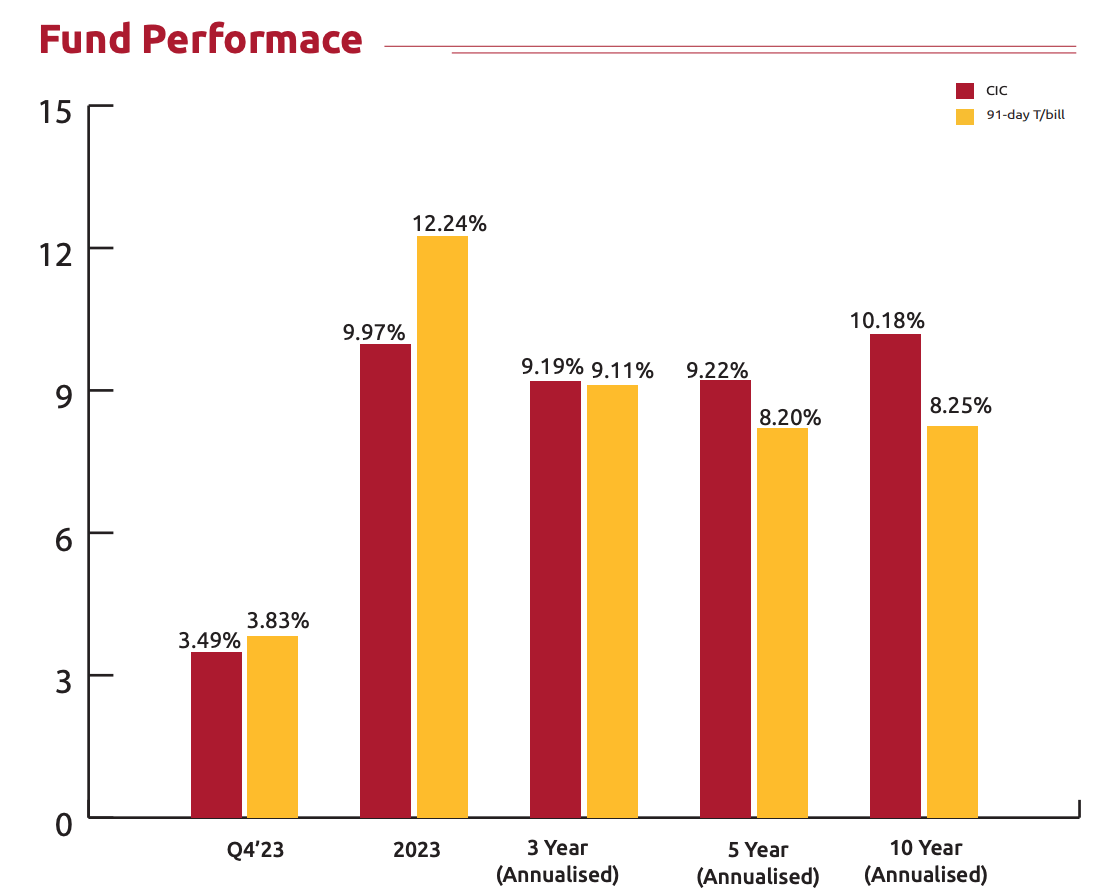

Fund Performace

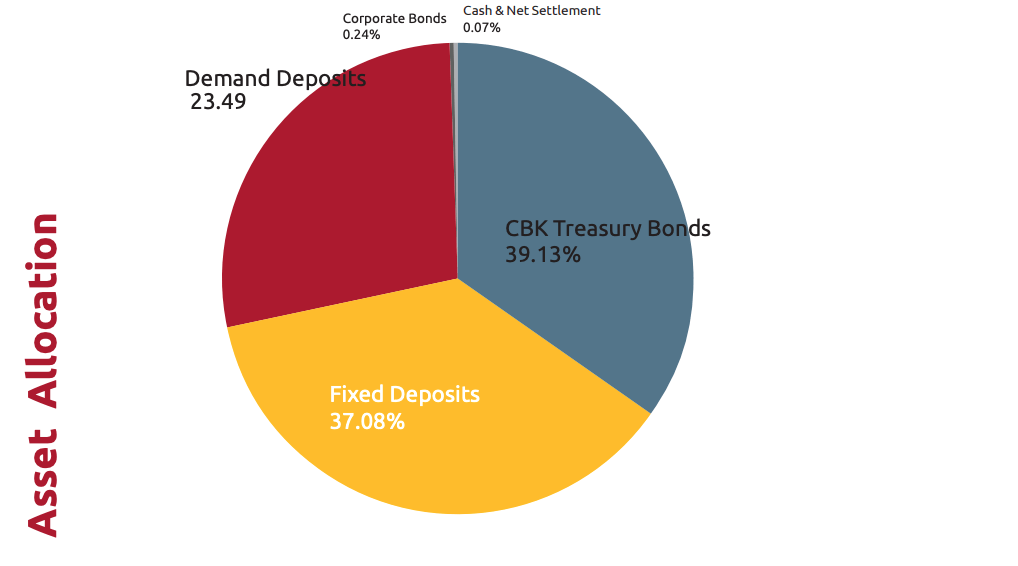

Asset Allocation

T- Bill Rates

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantees on the client’s capital as the performance of units in the fund is determined by changes in the value of underlying investments hence value of your unit trust investment.