At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

Fund Manager | CIC Asset Management Ltd |

Launch Date | Nov - 20 |

Risk Profile | Low |

Trustee | Kenya Commercial Bank |

Custodian | Co-op Custodial Services |

Auditors | PWC |

Minimum Investment | USD 1000.00 |

Minimum Additional Investment | USD 100.00 |

Initial Fee | Nil |

Annual Management Fee | 1.5% |

Distribution | Monthly |

Fund Objective

Investors who are seeking ;

- Capital preservation whilst not seeking long-term capital growth.

- A high degree of capital stability and with a risk neutral appetite.

- Currency diversification.

Key Benefits

- Liquidity: The client is able to withdraw their funds at short notice with no penalty fees.

- Flexibility: The client is able to switch or transfer funds to another fund that he/she may have with CICAM.

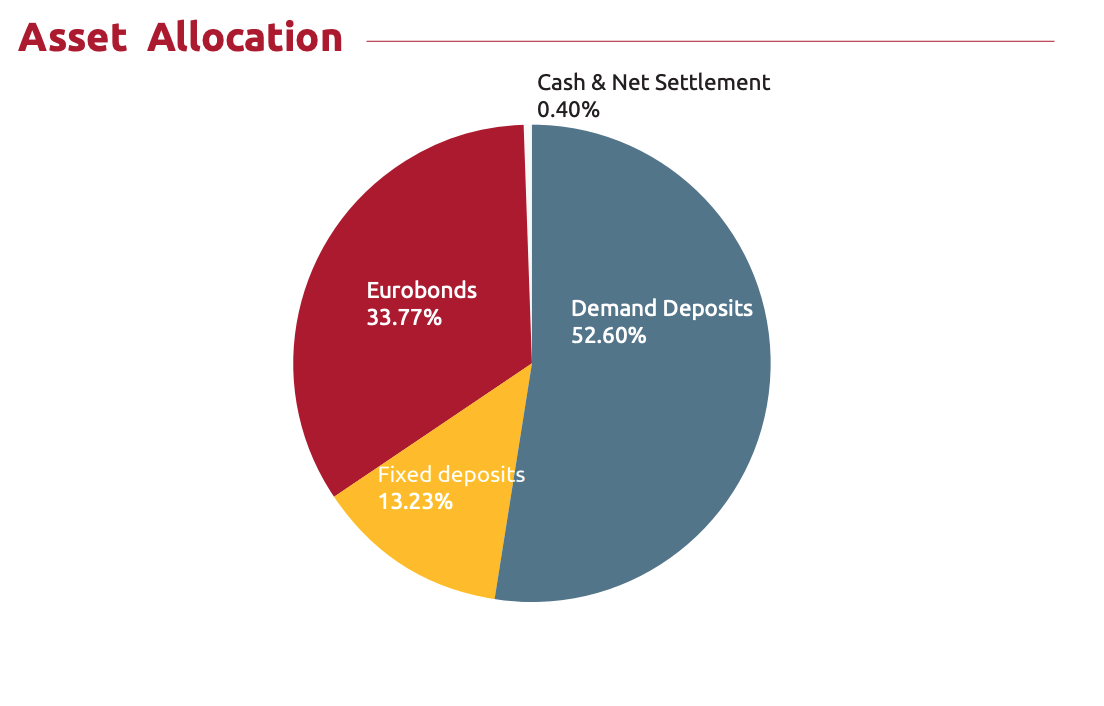

- Security: The fund invests in government paper and liquid instruments.

- Competitive Returns: Interest is calculated daily and credited at the end of each month. As an institutional client, the fund benefits from placing deposits in large sums and as such is able to negotiate for competitive rates.

- Professional fund management: prospective investors benefit from the expertise of our seasoned professionals.

Outlook

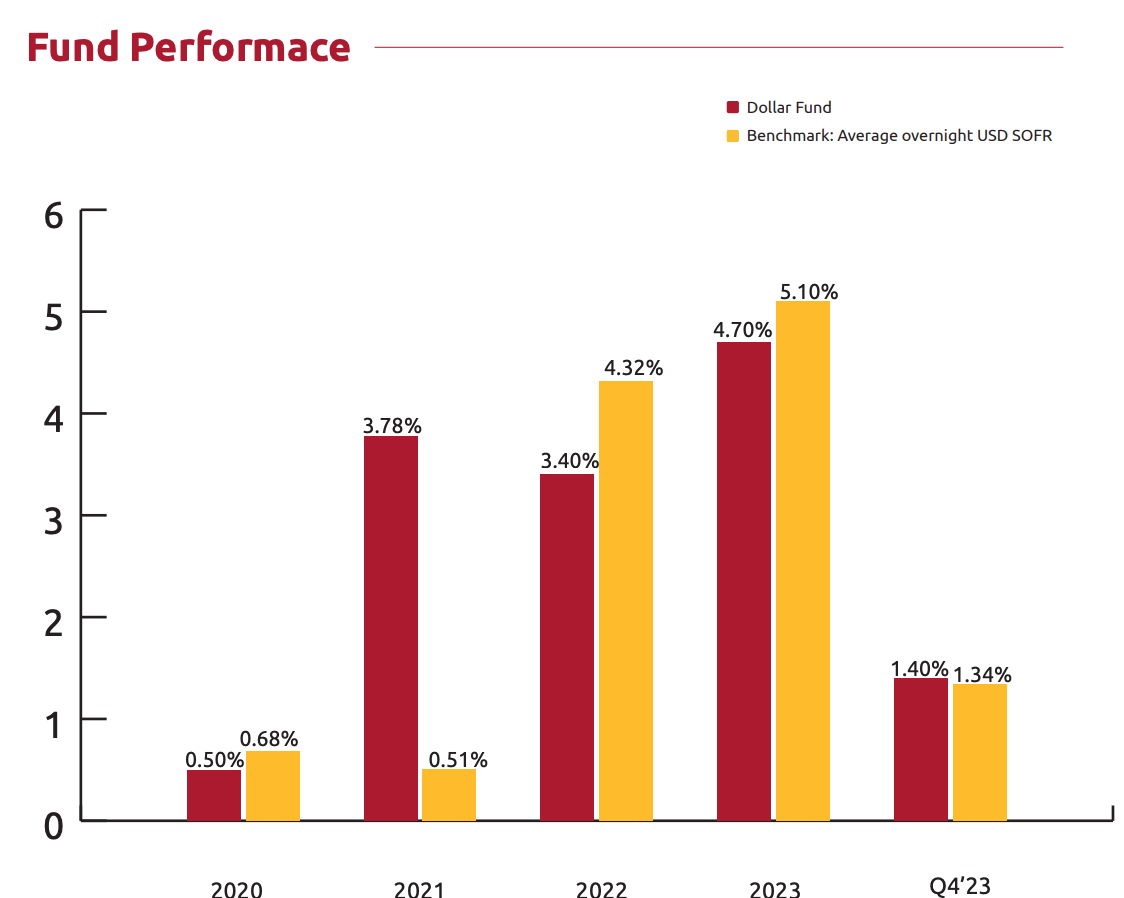

USD rates are expected to decrease in 2024. However, the KES depreciation against the USD implies significant upside for KES investments into USD assets. We expect the fund to register strong performance in 2024 on the back of high yielding USD assets in the current environment.

GDP

Global growth projections for 2024 are muted, as countries grapple with higher interest rates, shrinking fiscal flexibility, and trade fragmentation. Ongoing geopolitical conflicts and tensions are likely to depress growth further, while adding to inflationary pressures that are beyond the control of central banks. On the positive, sustained disinflation should allow the Fed to consider reducing policy rates as early as 2Q24, which should mitigate head-winds to growth and invigorate capital expenditures in anticipation of a cyclical economic rebound.

Inflation

In Dec 2023, US inflation rose 3.4% on an annual basis in Decem-ber, above the 3.2% increase economists were expecting. The inflation rate is still above the 2% policy target hence Fed rate cuts are only likely come in once inflation is within target.

Exchange Rates

In 2023, the KES depreciated 26.8% against the USD. The steep depreciation is mostly attributable to increased dollar demand amid low USD liquidity. We expect continued depreciation on the back of a weak macro backdrop in Kenya.

Interest Rates

The performance of global bond markets in 2023 was volatile as investors weighed the possibility of central banks pushing out the timing of interest rate cuts because divergent inflation readings.

Fund Performance

Asset Allocation

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantee on the client’s capital as the performance of units in the fund is determined by change in the value of underlying investments hence value of your unit trust investment