At CIC we are committed to maintaining open and transparent communication with our shareholders and investors in order to nurture a strong relationship with them.

Market Commentary

Key Features

Fund Manager | CIC Asset Management Ltd |

Launch Date | Jun - 11 |

Risk Profile | High |

Trustee | Kenya Commercial Bank |

Custodian | Co-op Custodial Services |

Auditors | PWC |

Minimum Investment | Ksh 5,000.00 |

Minimum Additional Investment | Ksh 1,000.00 |

Initial Fee | 2.50% |

Annual Management Fee | 2.00% |

Distribution | Semi-Annual |

Fund Objective

- Long-term investments

- Long-term capital growth at high risk

- Benefit from a well-diversified portfolio of market instruments.

Fund Outlook

The fund continues to be conservative, being overweight short-term near cash assets cognizant of the downturn in the equity market due to the impact of currency depreciation and low USD liquidity which continue to weigh on market prices.

GDP

In Q3 2023, economic activity grew by 5.9% with positive effects from a recovery in the agricultural sector and tourism receipts. CBK projections show that Kenya’s annual real GDP growth is expected to come in at 5.5% in 2023.

Inflation

The inflation rate closed the year at 6.6% which was within the upper bound of CBK’s target 7.50%. The disinflation was largely due to a slower growth in the food & non-alcoholic beverages following improved supply from better weather conditions.

Interest Rates

In 4Q23, the short term tenors closed at 15.88%, 15.97% and 15.90% for the 91, 182 and 364-day papers. Investors remained biased towards short maturities.

Equities

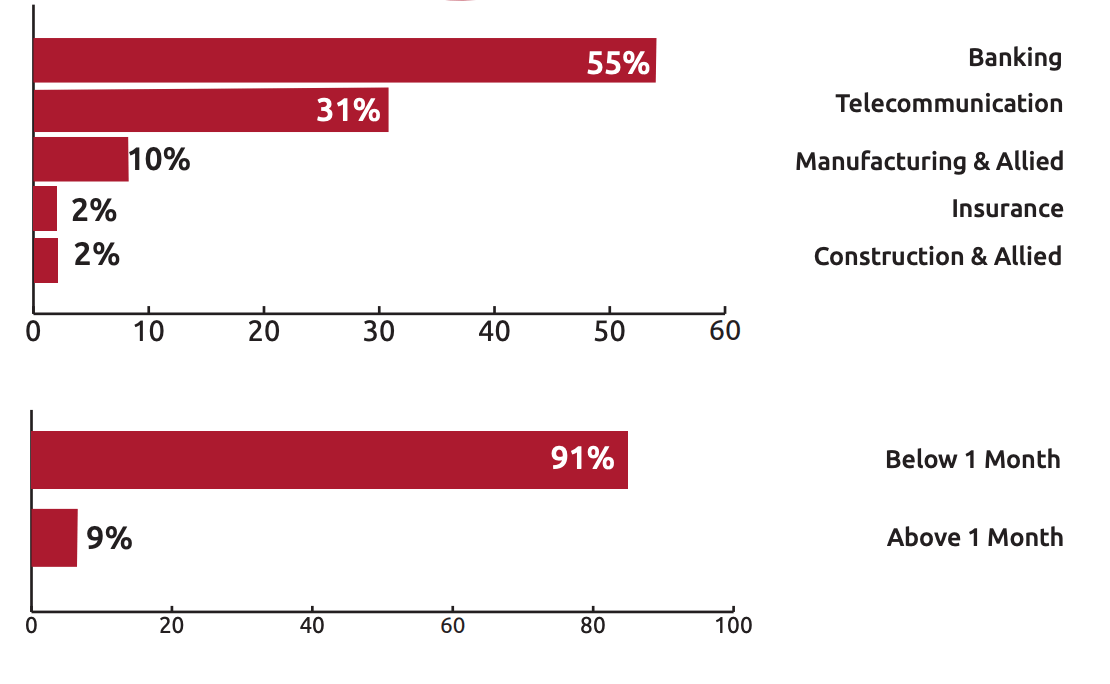

The NSE-20 and NASI declined by 4.2% and 11% respectively led by sell off in blue-chip counters such as KCB Bank, Equity Bank and Safaricom. Overall, investor risk appetite remains muted due to the tough macroeconomic environment and high interest rates in the money markets.

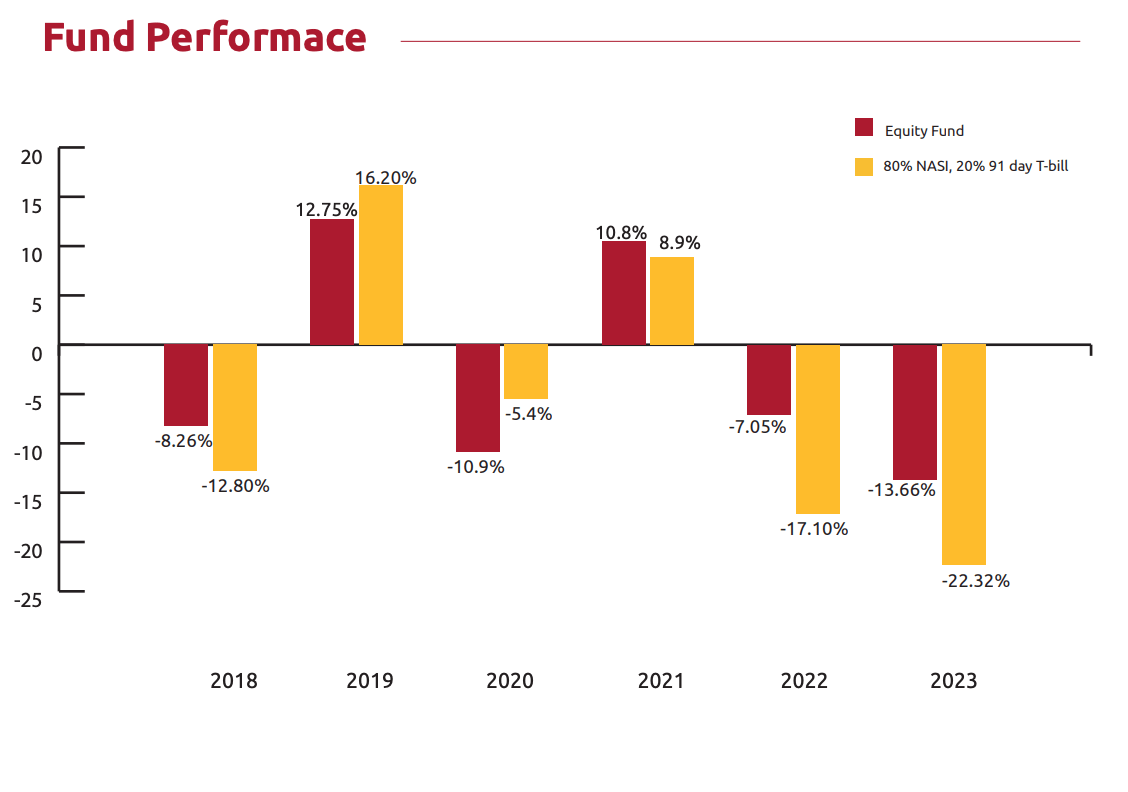

Fund Performance

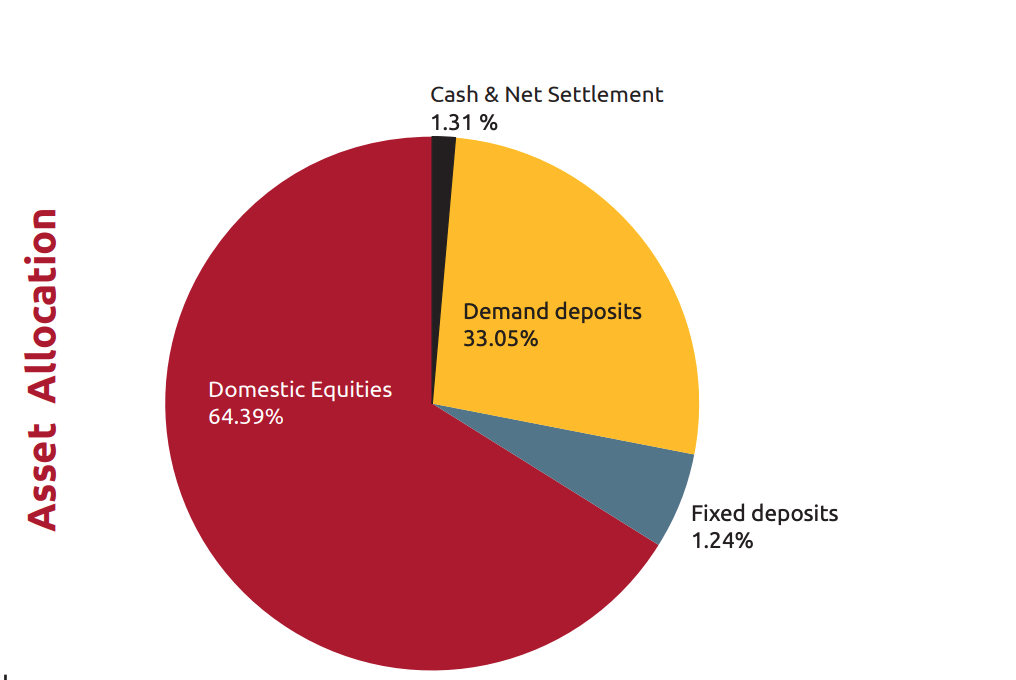

Asset Allocation

Statutory Disclaimer: The value of units may go down as well as up and past performance is not necessarily a guide to the future. There are no guarantee on the client’s capital as the performance of units in the fund is determined by change in the value of underlying investments hence value of your unit trust investment